In addition, the CBS conducts special programmes on request of public and private sector institutions to meet their emerging needs. All the CBS programmes are conducted by well experienced and exposed local and international professionals. Most people envisage banking as the safety of money and the provisions of banking services we need such as electronic payment systems, ATMs, changing money and converting currency and "traditional" deposit banking fits that description pretty well. Originally bank deposits were bailment and the banks were simply money warehouses. They were paid to look after their customers' money and to provide useful services. The bank had absolutely no claim, whatsoever on that money - if they went bust their creditors had no claim on that money either.

Bank Deposit is a sum of money lodged in a bank for the purpose of earning interest. It is a customer beneficial service that the bank provides to its customers where they will be paid a certain amount of interest on the sum of money that they had deposited in the bank in the form of bank deposits. This concept of bank deposit is entirely based on the terms and conditions of each bank which differs from bank to bank and from country to country. In this assignment the nature bank deposits of Sri Lanka have been discussed based on the data collected from the various sources which are duly footnoted. The Customers banking needs are only few clicks away due to the application of bank deposits schemes in Sri Lanka. It lets you bank with the utmost ease, convenience and security through up-to-date technology.

Your transactions and activities are protected by the highest level of security. Banka in Sri Lanka are committed to high levels of online banking security and have introduced the use of a Security Device as an extra layer of protection to ensure that your banking information and transactions online are safe and secure. With this added security feature, you can enjoy greater peace of mind knowing that the online transactions have been further authorized by you only. Visioned to be the best solutions provider to the financial services industry, IBSL has produced around 5,000 members to the banking and finance sector. Institute examinations are designed to provide expertise and knowledge as well as to meet challenges associated with the competitive banking & finance environment in a professional manner.

A significant part of the members and the student base of 30,000 are proud JMCians who are oriented in the industry, both locally and globally. IBSL membership is one of the most sort after qualifications in the banking sector. Accreditation of the institute and our well-experienced panel of lecturers provide a vivid background for you to learn.

If you are aiming to build a career in banking and planning to pursue any course from the list of banking courses. There are no banking courses after 10th but you can start building the base of your career. There is no restriction in the stream that can appear for the banking exam but opting for a related stream is a bonus.

Streams such as commerce that involve subjects like accountancy can help you in the future. Commerce students have a better understanding of banking and able to gain skills and knowledge at the school level as well. After completion of your schooling, you can select anything from the list of banking courses based on your eligibility and interest. Financial deregulation and technological advancement have led the sri lankan banking industry to highly competitive environment. In sri lanka, the competition is not only among the local banks, but also from foreign banks.

In this context banking institutions would like to know how the customers select their bank and how they perceive the performance of banks in such competitive environment. The researcher selected sample of 468 banking customers from public and private banks of sri lanka. Responses were analyzed and presented through descriptive, correlation and regression analysis. The findings showed that the security and service quality were the two most crucial factors when selecting a bank in sri lanka.

Significant gender and education level factors in bank selection were observed. Study concludes that sri lankan private banks perform better on those factors than the public banks in sri lanka. Further, the IBSL is now working for introduction of a professional graduate programme in banking and finance in order to provide learning and training opportunities at graduate level to professionals and career aspirants both locally and abroad. This programme focuses on contemporary issues within the challenging global banking and finance sector. You will gain up-to date technical and professional skills, through specially designed modules namely Contemporary Issues in anking, Risk Management in Banking and a dedicated project in International Banking and Finance. This is a course of studies that will pave the way for a senior position in local and international Banks.

Modules like International Money and Finance, Global Banking, Contemporary Issues in International Banking provides exposure and insights into the lobal banking sector. This differentiation is the advantage a student will gain in studying with a University of nternational repute. A degree in Banking and Finance offers you the opportunity to study the theory and practice of financial services and financial markets, and to analyse the broader role of the financial sector in the national and global economies. Banking and financial services is a highly competitive and rapidly changing sector in every modern economy and this course repares you to tackle it head on.

In recent years, forces such as globalisation, technological change, deregulation and international integration have fundamentally transformed the banking and financial services sector. Banks have sponded to growing competitive pressure by diversifying into new activities. The need of the day at the inception was to provide training with necessary knowledge and required skills to promote financial services in the rural sector and financial inclusiveness in the country as a whole. Therefore, the focus of the training courses at that time was concentrated on rural and development banking. Therefore, the Governing Board of the IBSL in terms of powers vested in it under the INSTITUTE of BANKERS of Sri LANKA Act determined to introduce this new ACADEMIC programme of IABF and DABF to replace the CBF and DBF programme .

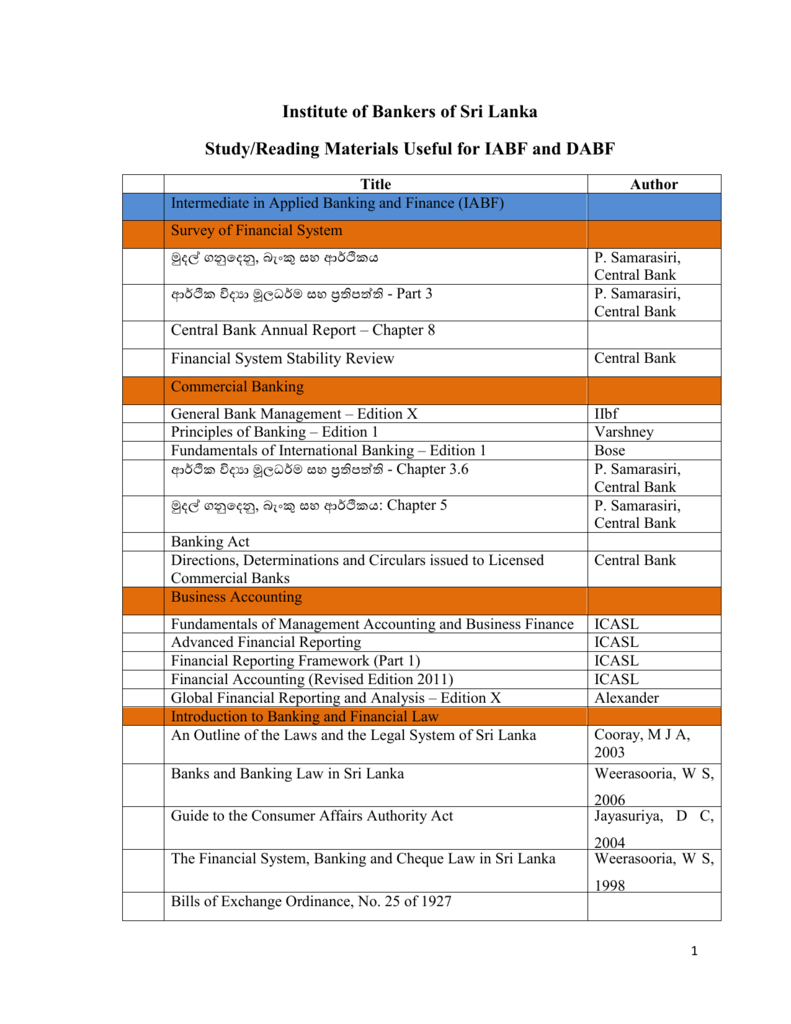

The target market contains employees and professionals in banking , finance and corporate sectors and students seeking qualifications to join those sectors. INSTITUTE of BANKERS of Sri LANKA - New ACADEMIC programme Subjects in the programme The programme consists of two courses and 17 specialized subjects. The two courses are Intermediate in Applied banking and Finance , the first level, and Diploma in Applied banking and Finance the Diploma Level.

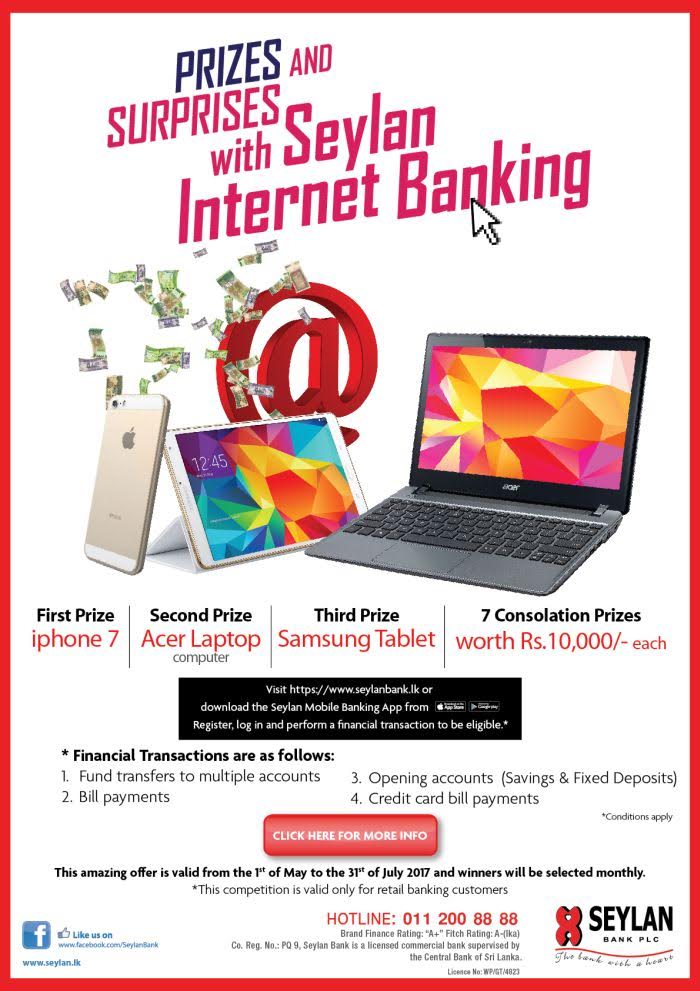

Accordingly, prospective candidates have to get through 13 subjects to complete the programme . Internet banking activities came into existence as a result of the evolution of new technology and it allows the customers to undertake their banking activities even staying at home. In general it is a feature introduced by the banks to its customers to log into their individual registered domain account on bank website and do almost every transaction they do by visiting the bank.

It is a good opportunity especially for the business owners of the country. Owners of Small and Medium Enterprises play a vital role in today's business world. When making business decisions, owners'/managers' characteristics are considerable and their adoption to e-commerce is significant. Hence, the current study investigate the SMEs adoption of internet banking in Sri Lanka. The researcher's attempt is to identify the level of internet banking adoption by SMEs, the impact of perceived ease of use, perceived usefulness and attitude on internet banking adaptation and the most significant factor impact on internet banking adoption by SMEs.

For the current investigation, all the consumers who use internet service in SMEs in Colombo District is used as the target population and 200 consumers are selected as the sample by using stratified sampling technique. The collected data was analyzed using correlation analysis, regression and descriptive analysis methods. The findings of this study supports the previous findings on the similar area.

The results of this study showed that there is a positive impact of perceived ease of use, perceived usefulness and attitude on internet banking adaptation. Further, it revealed that all factors are positively impact on internet banking adoption by SME's while perceived usefulness showed the highest impact. Gaining advanced knowledge and skills with continuous updates is the solution to stay afloat and command in any position in the workplace in such an environment. Like many other areas of economic activities, Banking and Financial Services Industry is forced to embrace this change and adjust accordingly for continuous progress.

As banks get modern, there are several different types of banking and finance jobs that students can aim for. There is a lot of scope in the field with financial sectors like insurance, stocks, funding, wealth management, investment, etc. For those who are looking for steady growth in their career, banking is a great field for them.

Appreciating the importance of social responsibility of promoting public awareness and improving economic and financial literacy, the CBS also hosts public lectures on contemporary issues related to the economy and the financial sector. School children, university students and academia are regular visitors of the CBS to attend sessions designed to enhance their knowledge and skills. In recent years Citi and its employees have supported rebuilding of homes post Tsunami. Citi also contributes strongly towards training and development in the financial services sector. Institute of Bankers of Sri Lanka, also abbreviated as IBSL, is a professional apex body of the banking education in Sri Lanka. It is one of the prominent institutes which carryout banking courses for the students and it is closely associated with Central Bank of Sri Lanka.

The institute was formally established as Bankers' Training Institute in 1964 by the Central Bank of Sri Lanka. Bankers' Training Institute was reincorporated in 1979 as Institute of Bankers of Sri Lanka under the provisions of Parliament Act no 26 of 1979. We are a university college that exists to advance banking and finance by providing outstanding education and thinking, tailored to the needs of individuals, business and society.

The Central Bank of Sri Lankaserves as the country's central bank and exercises supervisory powers over its financial system. Established in 1950, it is responsible for the conduct of monetary policy and oversight of banks in Sri Lanka. As a member of the Alliance for Financial Inclusion, the central bank is engaged in developing policies to promote financial inclusion. Apart from DABF, IBSL has Diploma Programmes which are especially designed to improve specialised areas of Banking. Those diplomas include Postgraduate Executive Diploma in Bank Management, Diploma in Credit Management, Diploma in International Trade, Diploma in Treasury and Risk Management, Diploma in Islamic Banking etc. Bank or Finance company employees who directly involve in credit management; international trade etc. in their respective bank or finance company can follow these specialised courses.

Even Diploma in Treasury and Risk Management course has been recognised by the Central Bank of Sri Lanka for officers who handle their Bank's primary dealing/ treasury activities. IBSL as the professional body for Bankers, offers wide range of Certificate and Diploma programmes, which are designed to enhance the knowledge of Bankers. The flagship programme is the Diploma in Applied Banking and Finance , completion of which can get the Associateship of the Institute.

In order to do the DABF all students need to complete the first stage which is Intermediate in Applied Banking and Finance . Every bank in Sri Lanka recognize this for their promotions and confirmation of its employees to the permanent staff. The IABF consists of six subjects including four compulsory subjects and two optional out of four. The Diploma level – DABF, consists of seven subjects including four compulsory subjects and three optional subjects out of four. IBSL is the only institution authorized to offer banking qualifications in Sri Lanka, and plays an important role in training personnel involved in the country? Over many years, Sri Lanka has been experiencing a progressive expansion in the financial and non-financial sectors with the rapid development in the economy and with the integration of the financial sector with the global financial system.

The RB&STC, being the fore front of promoting knowledge and training, particularly the financial sector progress, diversified its programmes to suite the changing environment. Recognising these developments, the Monetary Board of the Central Bank of Sri Lanka renamed RB&STC as the Centre for Banking Studies in 1998. Citi offers a full set of products and services to corporate clients from its branch in Colombo. Since its establishment in 1979, Citi Sri Lanka has led local market innovation in terms of cash management solutions, trade financing, corporate finance, and most recently risk management and hedging. The bank offers banking products and services to individuals, corporate and institutional customers, and small and medium enterprises in Sri Lanka. It operates through Corporate Banking, Consumer Banking, SME Banking, Leasing, Treasury Function, Investment Banking, Insurance Brokering, and Property Management segments.

Established in 1961, People's Bank is one of the state-owned banks in Sri Lanka. It provides personal banking products and services, corporate banking services, treasury services and development banking services, and overseas customer services. The rapidly expanding financial sector of Sri Lanka needs professionals with updated advance knowledge and skills. The Institute of Bankers of Sri Lanka offers affordable professional qualifications that also enable aspirants to gain an academic qualification simultaneously, right here in Sri Lanka.

During the past few years, Sri Lanka's Banking and Finance sector has grown rapidly. The Faculty of Engineering of Sri Lanka Institute of Information technology is the epicenter of engineering education, research, knowledge creation and distribution in Sri Lanka. Comprised of prominent lecturers, researchers and a helpful academic staff, the students are guaranteed to receive quality education and knowledge. Though advance technology brings about many advantages to financial institutions and its customers, it also brings in great risks of information security and electronic fraud. Spearheading in implementing a variety of cutting-edge technology based payment innovations in the country, LankaClear has revolutionized the entire financial services landscape in Sri Lanka over the past two decades.

A number of these payment solutions are pioneering initiatives in the South Asia region. The institute is managed by governing board of 12 high ranking banking sector professionals including 2 members from CBSL. The purpose of the institute is to provide education in Banking and Finance for banking and non-banking personnel. IBSL provides membership of the institute in five categories including Honorary Fellows, Fellows , Associate Members, Associate Members and Student Members . Results will be released by the Governing Board after a careful scrutiny and external audit on the compliance with the internal controls on the examination process and quality. Official ACADEMIC transcripts will be issued to members after sitting each cycle of examinations.

The final ACADEMIC transcript confirming the qualification and an official certificate will be issued once a member completes each course. The official certificate of DABF will be awarded at the Annual Convocation of the IBSL. Requests for re-correction of answer scripts are permitted after release of results at a service fee 6. INSTITUTE of BANKERS of Sri LANKA - New ACADEMIC programme Registration for the programme To register as a student member of the IBSL to sit IABF, the following requirements should be complied with.

When you log on with a security device, you get access to the full online banking service. Founded in 1955, DFCC Bank provides financial products and services in Sri Lanka. The bank operates through a network of 139 branches and 50 service points, as well as approximately 4,500 ATMs. The Colombo Academy of Hospitality Management , Sri Lanka's largest hotel school, is a joint venture between William Angliss Institute , Australia. Based in the SLIIT campus in Malabe, we are a dedicated centre for Hospitality, Tourism, Foods and Events.

William Angliss has a proud history of over 75 years, and in our Melbourne campus we annually have over 21,500 local clients and students, and 1,300 international students from over 45 countries with more than 100,000 graduates worldwide. It is a professional pathway which is suited for creative people with sensitivity and an ability to understand the technological aspects of building and construction. The Professional Development Program unit of Sri Lanka Institute of Information Technology is the entity that is responsible for the delivery of continuous Professional Development Programs to satisfy the needs of the industry. This area has been identified as a propitious niche market for SLIIT due to its core competencies and the demand available in the industry for the programs. The students reading for the Professional Development Programs offered by SLIIT attain a competitive advantage in a highly competitive business arena as SLIIT provides a focused academic trajectory. The William Angliss Institute @ SLIIT, is a joint venture between William Angliss Institute, Melbourne and is based in the SLIIT campus, Malabe.

We are a dedicated centre for Hospitality, Culinary Arts, Tourism Studies and Events. William Angliss has a proud history of over 75 years, and in our Melbourne campus we annually have over 22,000 local clients and students and 1,800 international students from over 60 countries with more than 100,000 graduates worldwide. In our quest to promote electronic payments in the country thereby empowering every Sri Lankan with faster, convenient, security and affordable access to banking services; as the National Payment Network of the country. Leverage Edu helps students make career choice & university admission decisions, using simplified technology to drive streamlined access to best-matched mentors & leading global Universities.

It depends upon the institution or university student is completing a banking course. I was able to learn the concepts & it's applications on event management successfully. The competencies which I gained from the training programme will be very useful for my future career development. Who have already completed or completes CBF during the permitted period have the option to proceed to DABF or to DBF at their discretion. Student members who have received exemptions from CBF on or before 31st December, 2013, have the option to proceed to DABF or to DBF at their discretion on the basis of such exemption. Selected subject exemptions from IABF will be considered only for the major subject of degrees or other professional qualifications recognized by the IBSL if that subject is offered in IABF.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.