Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account.

For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement.

Transactions between enrolled users typically occur in minutes. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Know the Wells Fargo Online Banking features and benefits today. Availability may be affected by your mobile carriers coverage area.

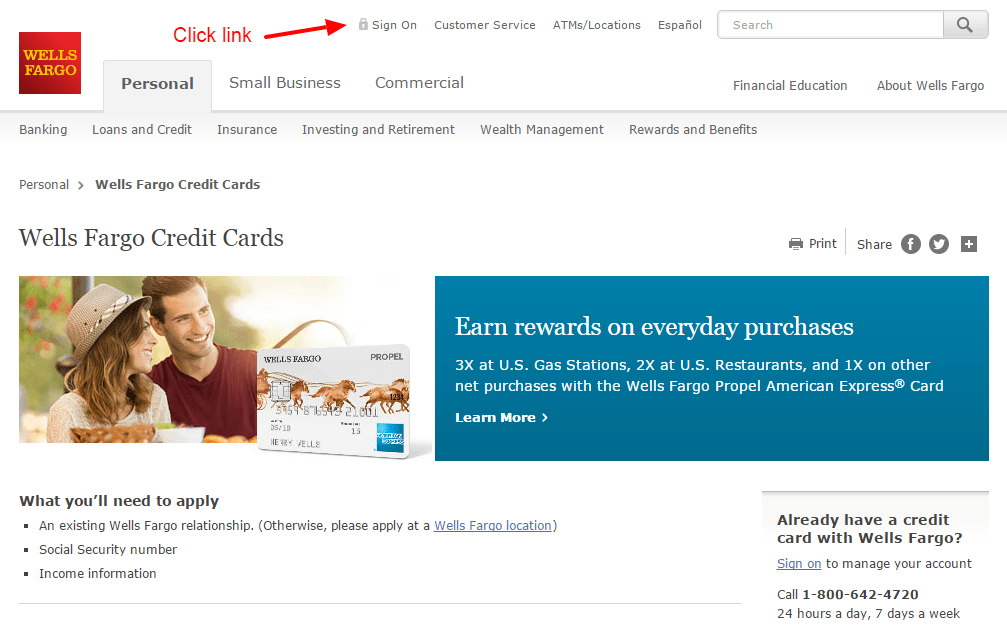

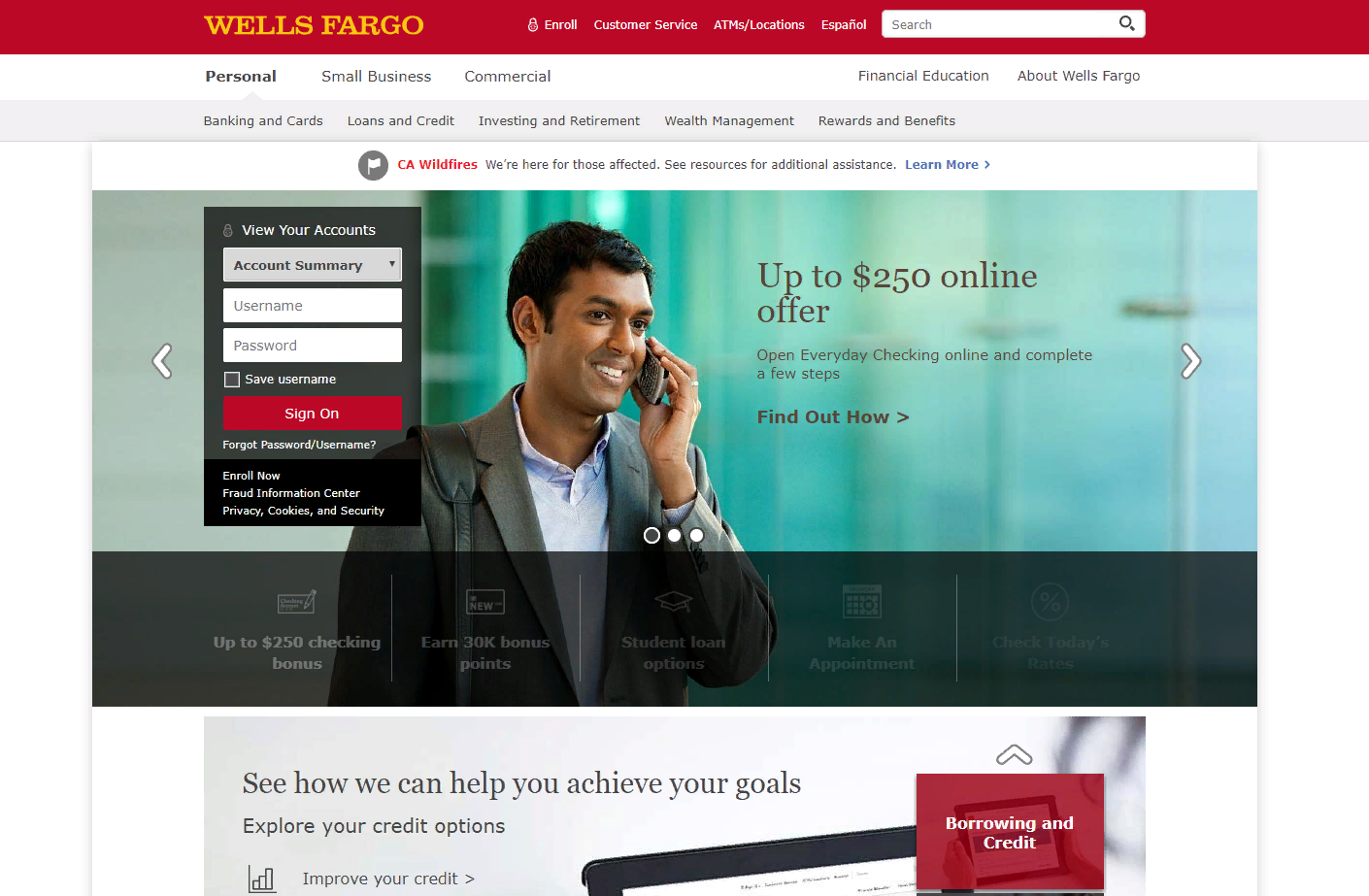

You Can Easily Manage Your Account With Wells Fargo Online Banking Login Page. With online banking through Wells Fargo Online you can monitor your balances and activity set up alerts and view statements all from your smartphone tablet or desktop. With Wells Fargo Online Banking access your checking savings and other accounts pay bills. To open a checking account or any other type of account youll also need the following. Cross-selling, the practice underpinning the fraud, is the concept of attempting to sell multiple products to consumers. For instance, a customer with a checking account might be encouraged to take out a mortgage, or set up credit card or online banking account.

Success by retail banks was measured in part by the average number of products held by a customer, and Wells Fargo was long considered the most successful cross-seller. Richard Kovacevich, the former CEO of Norwest Corporation and, later, Wells Fargo, allegedly invented the strategy while at Norwest. Under Kovacevich, Norwest encouraged branch employees to sell at least eight products, in an initiative known as "Going for Gr-Eight". Checking and savings accounts and credit cards for your everyday business expenses and cash management.

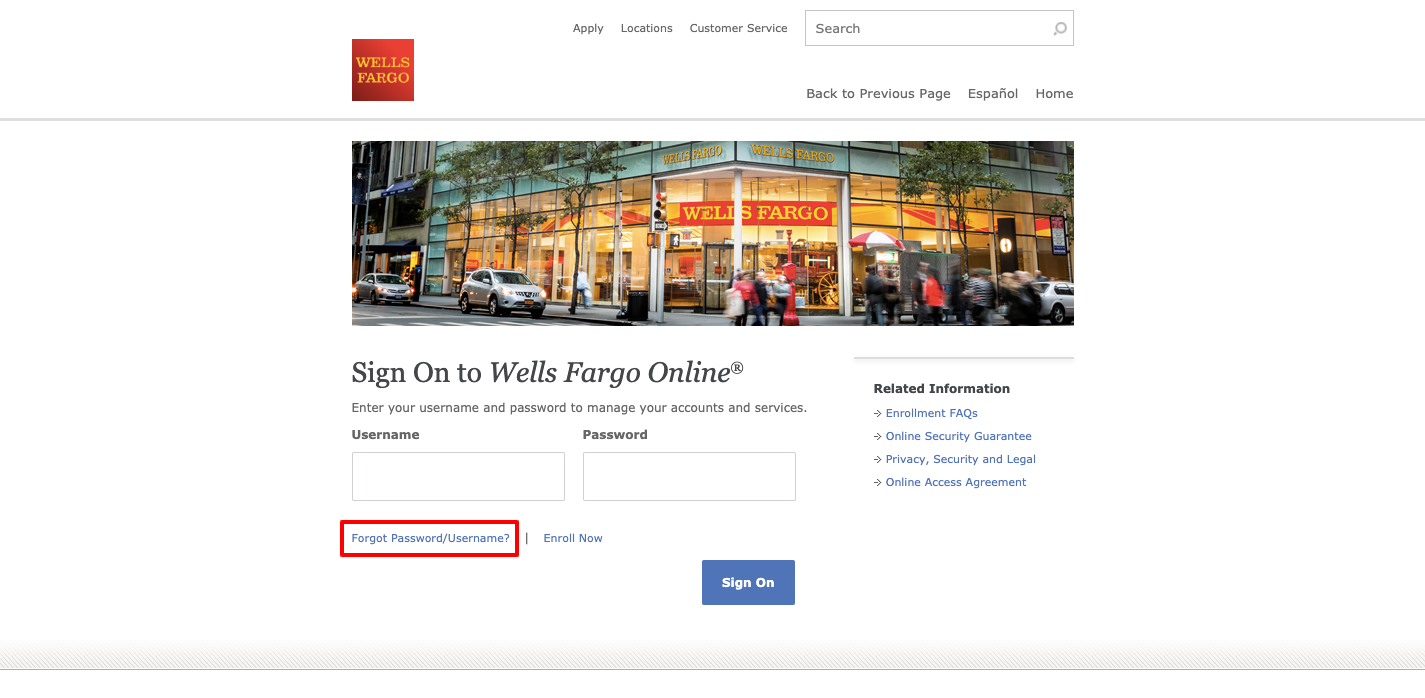

During the enrollment process you will select a username and password. You can access almost all banking facilities from Well Fargo Online Banking login page. If you receive electronic delivery of brokerage statements and documents you will need to sign on to Wells Fargo.

Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day.

The fee can be avoided if a covering transfer or deposit is made on the same business day. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off.

For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply. You can access Wells Fargo Online and the banks mobile app via a secure and simple Wells Fargo banking login.

You are leaving Wells Fargo Dealer Services and entering a website that Wells Fargo Dealer Services does not control. Like most major banks Wells Fargo offers online banking and other services that give customers convenient access to their accounts online bill payments and financial transactions. And up to 7 years for deposit accounts home mortgage accounts and trust and managed. Wells Fargo offers Individual Retirement Accounts IRAs and it also services employee-sponsored 401 k retirement plans.

Enter an invoice number or the serial number of the equipment being financed. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services LLC WFCS and Wells Fargo Advisors Financial Network LLC Members SIPC separate. When you provide a phone number to us, you agree that you own or are authorized to provide the telephone number to us. To help protect your account security, Wells Fargo does not support SMS or MMS functionality for recognized VoIP, prepaid or landline phone numbers.

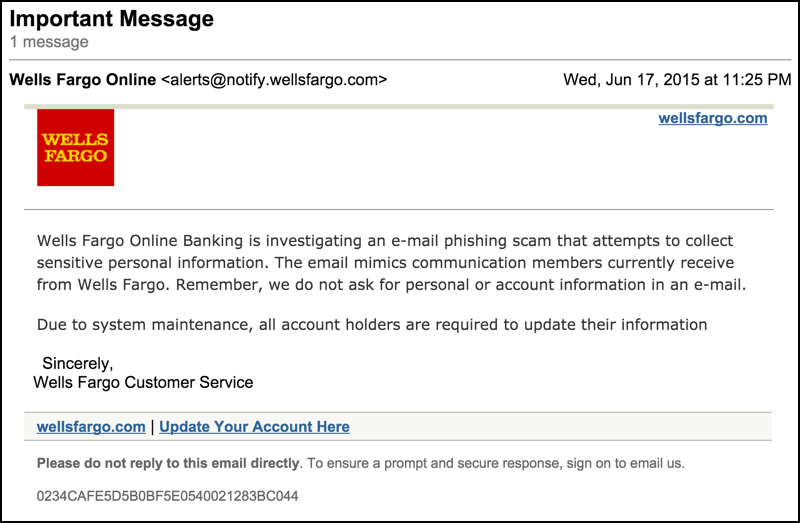

In order to receive text messages from Wells Fargo, such as one-time passcodes or suspicious activity alerts, an eligible phone number and mobile device are required. Wells Fargo may automatically send you certain alert messages via email, text message, push notification, and/or by other means, including to your mobile device. These messages may include notifications about potential fraud on your accounts, debit card or credit card, recent account activity, or changes to your online profile.

You can opt not to receive push notifications by turning off push notifications on your Wells Fargo Mobile app. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone.

For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Turning off your debit card is not a replacement for reporting your card lost or stolen. Any digital card numbers linked to the debit card will also be turned off. Availability may be affected by your mobile carrier's coverage area. A Funding Account may not be used to pay any part of the balance you owe on that Funding Account.

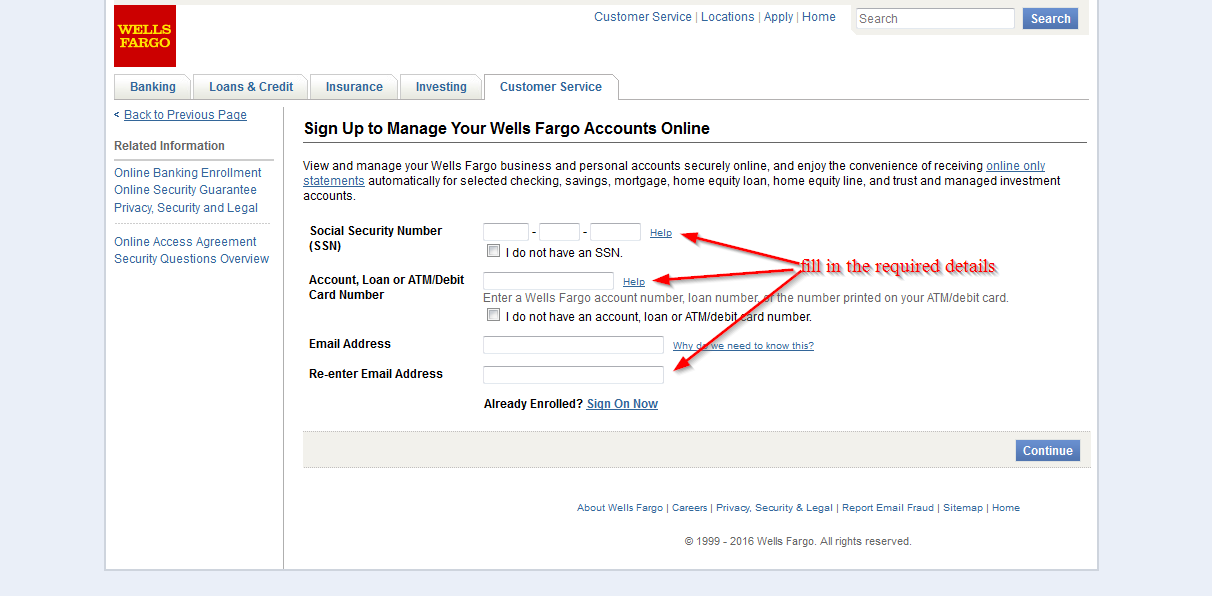

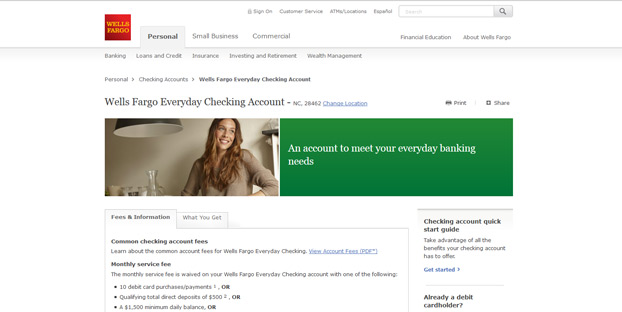

Eligible Accounts that require two or more signatures or authorizations to withdraw or transfer funds may not be used as a Funding Account. A Funding Account must remain linked to the Service in order to use the Funding Account for current, future and automatic Bill Pay payments. Wells Fargo Everyday Checking is Wells Fargo's most popular account for day-to-day banking. Sign up for Wells Fargo Online to view and manage your personal and business accounts securely online, anywhere or anytime you have internet access.

You'll need your Social Security Number, Wells Fargo Bank, N.A. After answering a few questions during the sign-up process, you'll have an opportunity to create a username and password. If applicable on your account, these monthly fees are in addition to your monthly service fee. Note that these liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and do not apply to business accounts.

Our account agreements regarding unauthorized debit card, ATM Card, Wells Fargo EasyPay®, and consumer and business credit card transactions may give you more protection, provided you report the transactions promptly. Please see the agreement you received with your ATM, debit card, Wells Fargo EasyPay, or consumer and business credit cards, and the Eligible Account agreement. A big source of Wells Fargo's value comes from their fairly low costs. The vast majority of customers will not have to pay monthly service fees, and they have made communicating all other fees a priority. They offer optional overdraft protection, as well as frequent sign-up incentives for other Wells Fargo business products and loans. At the platinum checking level, there aren't even fees for stop payment requests, money orders, or your first two monthly domestic wire transfers.

Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts . We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account. The service is subject to applicable transfer and advance fees.

Overdraft Protection is not available for Clear Access Banking℠ accounts. For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices. Investment products and services are offered through Wells Fargo Advisors.

We recommend you select a unique username and password and memorize it rather than writing it down. You can open anaccount onlinewith SDCCU in just a few easy steps. You can transfer funds from an existing SDCCU account, with your credit or debit card or from a checking or savings account at another financial institution.

You'll just need your account number and the bank routing number of the bank account you are transferring from. Why can I no longer download my credit card transactions into my software? To download credit card transactions, sign on to KeyBank online banking and select Download Transactions. You will be able to download credit card transactions into your Quicken software. QuickBooks download for credit card information is not available at this time. Mobile deposit is only available through the Wells Fargo Mobile® app.

See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts. You can check account balances, set up a payee, pay bills, or transfer funds; quickly find an ATM or branch location; and receive alerts to help track your account activity. You can also enroll in text banking to get account information in seconds. For deposit accounts, you may view online images of the individual checks posted to your account.

If you currently receive an account statement with check images in paper format, once you choose online-only statements and documents, you will no longer receive the check images as part of the statement. You can ask us to mail a photocopy of a cancelled check to you . For most debit card purchases, we receive the payment request, including the actual transaction amount, within three business days of the transaction. We then remove the transaction from your list of pending transactions and add the funds back to your available balance. Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction.

These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option. In online banking, you will first need to add an account. From within any account, select the Transfer Money icon and choose Add An Account. Once the account is added and confirmed, it can be used for transfers.

You can set up same day/future dated/recurring transfers in either online banking or the mobile app. Only select Apple devices are eligible to enable Face ID®. If you have family members who look like you, we recommend using your username and password instead of Face ID® to sign on. Set up is required for transfers to other U.S. financial institutions, and may take 3–5 days. Customers should refer to their other U.S. financial institutions for information about any potential transfer fees charged by those institutions.

See Wells Fargo's Online Access Agreement for more information. Employees were encouraged to order credit cards for pre-approved customers without their consent, and to use their own contact information when filling out requests to prevent customers from discovering the fraud. Employees also created fraudulent checking and savings accounts, a process that sometimes involved the movement of money out of legitimate accounts. The creation of these additional products was made possible in part through a process known as "pinning". By setting the client's PIN to "0000", bankers were able to control client accounts and were able to enroll them in programs such as online banking. You can request for your account statement through the online banking or the banking mobile app, and it will contain all your transaction history since you opened your account with Wells Fargo.

Internet banking and the mobile banking offers the most convenient way of banking and they are 24/7 available. That is to say you can view or check your wells fargo transaction history or request for your account statement through these bank services. With our mobile app, you can quickly sign on using biometric authentication,, deposit checks, pay bills, transfer funds, set up alerts to help monitor your activity, and more.

You can check account balances, pay bills, or transfer funds; quickly find an ATM or branch location; receive and send money with people you know and trust using Zelle®; and receive alerts to track your account activity. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. Then just enter the recipient's name, mobile phone number, email address or account number, the amount of the payment, your personal message and click Send. Review your account summary, transaction history, copies of paid checks and your monthly eStatements.

View and order checks, pay bills with Bill Payer Plus™ and more. You can also download your account history data to Quicken® or QuickBooks™. Can I pay my credit card, loan or line of credit online from a non-KeyBank account? Yes, use the Make a Payment action button on the Account Details page. Payments from other financial institutions may take a few days to process. Payments processed from Key using Bill Pay or funds transfer are guaranteed and process same day.